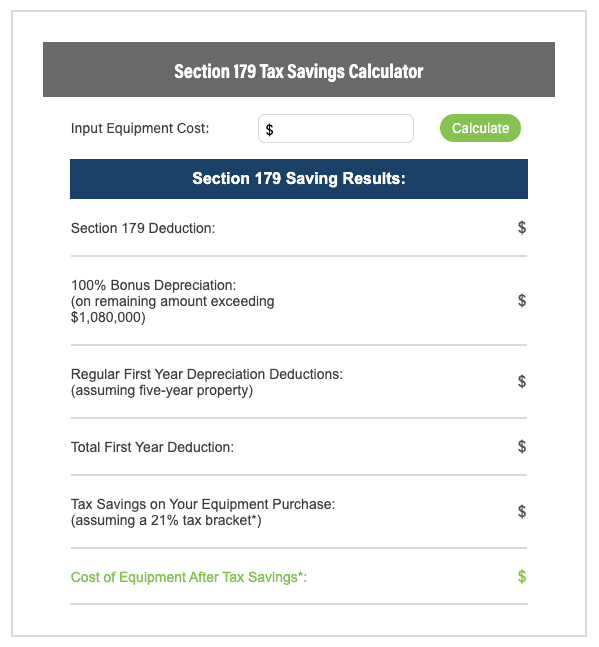

Streamline your document workflows, enhance security, reduce costs, and leverage Section 179 for tax savings, tailored for businesses in Frederick, Louisville, and Erie.

Tag: section 179

Looking to upgrade your office copier in Boulder or Louisville? Discover the best Canon, HP, Kyocera, and Fuji Xerox models for 2026 — and why now’s the time to act before December 31 to maximize tax savings with Section 179. Plus, explore how a full office tech refresh with access control and managed IT services from ABT CreativeTech can future-proof your business.

Master the collate function on your Kyocera printer with this in-depth guide tailored for Colorado businesses. Learn setup steps, troubleshoot common issues, and discover how upgrading your device with Section 179 can boost productivity and savings.

As Q4 begins, it’s the perfect time to future-proof your business. From maximizing Section 179 tax deductions to upgrading outdated equipment, security systems, and communications tools, smart year-end investments can boost productivity and save money. Here’s how Colorado businesses can prepare for a strong 2026.

Looking to upgrade your office printer before year-end? Explore the best all-in-one printers for small businesses in 2025—plus how to save big with Section 179 and beat rising costs in 2026.

Discover everything you need to know about printing plotters—from choosing the right model to maximizing your Section 179 tax savings before year-end.

Maximize your end-of-year budget with Kyocera device upgrades. Learn how Section 179 tax deductions make Q4 the perfect time to invest in high-performance copiers and printers.

Q4 is your last chance to upgrade office technology, cut costs, and claim tax deductions before 2026. This guide walks Colorado businesses through smart copier, IT, and VoIP decisions that pay off now and into the new year.

When it comes to small business management and tax codes in Colorado you may be wondering how best to use Section 179 to reduce your operating costs.