That is a good question, with a lot of variables and a range of options. Let’s go through some basics to help figure out a close answer. We’ll consider price ranges, how you purchase (finance, lease, rent, or cash), finance terms, and total cost of ownership of your copier, printer, or MFP.

How much should I pay for my copier/MFP?

So, what equipment and finishing does your office need?

First, it depends on what you need. If you think about it like buying a car, do you need a city commuter capable of parking in tight spaces with good gas mileage and limited seating or do you need heavy duty truck to tow 20,000 lbs? You don’t buy an F-350 for the first scenario nor do you buy a Honda Civic or smart car for the second. Similarly, with a printer / copier, your price will be different based on what you need.

MFPs for Smaller Office Needs

If you need a printer for a small office or home office with a handful of users, lower print volumes (maybe 2,000 pages a month), and printing letter to legal size, you may want a desktop multi-function printer (MFP) or printer. An MFP will cost a bit more because it will be able to scan and copy. Similarly, a color printer or MFP will cost more than a monochrome (black and white) device.

You can go to a big box store, like Staples, to get an MFP or printer, or you can buy from a manufacturer authorized dealer. Typically, the less expensive the hardware, the more expensive it will cost to operate. We’ll cover more of that later. In the case of an enterprise color desktop MFP, you could be in the $2,000 – $5,000 range depending on the brand, speed, and other options.

MFPs for Larger Office Needs

For something more robust, that prints on sheets up to 11 x 17 with higher monthly usage, you want to start looking at standalone models. This is common for groups of users in an office or higher volume environments. When looking at your office, it could make sense to eliminate smaller printers and consolidate use to a larger device with more capability. These will range in output speed from 25 – 70 pages per minute.

For 30 pages per minute (printing 3,000 – 6,000 pages a month), you are likely in the $5,000 – $12,000 range depending on additional options / features. At 70 pages per minute (printing 7,000 – 30,000 pages per month), you are likely at $15,000 – $40,000 depending on options and features. We won’t go into the more specialized production hardware costs as those are typically accessorized to meet the specific application.

MFP Lease and Loan Strategy

So now we have an idea on how much the device costs if you pay with cash, but most times printers / MFPs go on a lease, and sometimes they are financed with a loan. You should purchase using the method that matches your technology strategy. Most printers have a planned obsolescence from the manufacturer. Any given model will receive manufacturer support for seven to ten years before the manufacturer stops producing parts and supplies.

Manufacturers also continue to develop new technology for new model generations that are not backwards compatible. So, if you want to use the newest technology and plan to refresh your equipment, a fair market value lease is likely the best financing option. If you intend to use the equipment for more than five years, a $1 out lease, traditional loan, or cash purchase might be the best option.

What is the difference between an MFP lease and a MFP loan?

Both a lease and loan typically have a fixed term and may have similar monthly payment amounts. With both a lease and a loan, there is an element of interest, though the interest rate on a lease is not declared on the lease agreement. Lease approval is typically based on a credit rating and requires two or more years of credit history. Lease approval can happen very quickly, with no requirement to provide financial statements to the lessor.

A loan from a bank will likely require additional steps and time to secure, but will likely have a lower interest rate than a $1 out lease. Leases are non-cancelable and can only be terminated early by accelerating the remaining payments, usually paying an early termination fee or restocking fee, and often buying the hardware at fair market value to fulfill the terms of the lease. Loans are non-cancelable, but can often be paid off with no termination fee and excluding interest past the payoff date.

MFP Lease Options

A lease provides end of term purchase options, so you may not own the equipment at the end of the lease. With a fair market value (FMV) lease, the lessee can purchase the equipment from the lessor at the fair market value of the equipment, return the equipment to the lessor’s designated receiver, or continue making monthly payments until returning the machine to the designated receiver.

On a $1 out lease, the lessee will own the equipment at lease maturity. A lease frequently includes a penalty to buy out early, and there is no option to pay off principal and avoid interest if you want to pay off a lease early. Some leasing terms may not even include an option to buyout only the remaining payments and return the equipment early on a fair market value lease.

Similar to interest rates, lease rates will change depending on the market. Prior to 2022, lease rates fluctuated little, though you would definitely find different rates for the same terms based on the lessor. In our current environment, lease rates change about quarterly. Some companies will lock in a monthly payment for up to 90 days after credit approval, some rates / payments may not last as long.

Currently, you can expect a monthly lease payment on a 60 month FMV lease to run $175-$200 for every $10,000 in cash value, $275 – $300 for the same over 36-months. On a $1 out lease, $220-$235 for every $10,000 in cash value over 60-months or $330-$350 over 36 months.

How can you find out how much interest is included in your lease?

To calculate the interest included on a lease knowing what the lease will fund to the reseller. The funding amount is not disclosed on the lease, and the sales representative from the reseller may not actually know because many companies “pad” or add additional interest to what a third-party leasing company provides to their sales team. Some sales teams may also include a lower cash price than what a lease would fund because they don’t expect a buyer to pay cash or calculate the interest, so it makes the lease appear less expensive.

Your best bet is to take the cash price, and use that to determine an interest rate. If you get a really high interest rate, you may want to finance through a loan if available or pay the cash price. To determine the interest rate, you can use a rate calculator online. For a $1 out lease, there is no residual value at the end of the lease to consider. On an FMV lease, you need to factor in some residual value at the end of term and include that in the calculator.

Not all calculators will include this element. A good estimate on the residual value is 10-20% of the cash value of the lease. Some leases may specify a price at the end of the lease, but it is less common. A traditional loan should disclose the funding amount and / or interest rate directly.

Total cost of ownership: While there some aesthetic value to a printer, you aren’t buying one just to have it or in the hope it will appreciate. You intend to use the printer to produce something necessary to your organization. The cost to operate your printer will be determined by the printer you purchase. Open channel printers that are sold online or in a store such as Amazon or Staples may have a lower purchase price but will have a high operating price.

The toner available to purchase through the manufacturer will have low yields (the number of pages you can print per cartridge) than an enterprise version with similar speed and function. With enterprise printers, faster speed devices are typically built for higher print volumes and lower cost per image / print. You can easily calculate a cost per page for toner / ink by taking the manufacturer’s estimated yield and dividing it by the price. Additional costs include parts and labor as needed, paper, and the cost of energy.

A service contract on your printer is typically based on the number pages printed by the device. The cost of the contract usually includes toner / ink, parts, and labor. You may wonder why you pay for service when you don’t see a technician every month, or don’t need supplies every month.

A service contract based on print volume creates a steadier cost operation over time instead of paying in large spikes as you purchase supplies, parts, or labor. It also provides some risk mitigation against more costly hardware failures. Parts inevitably wear out or reach the end of life, and you don’t need to tolerate small deficiencies to avoid paying for a technician on a time and materials basis.

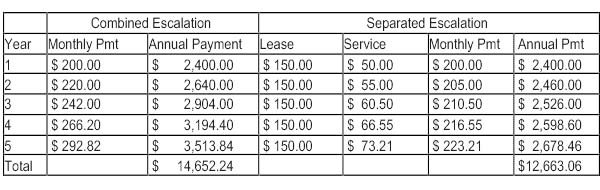

Price escalation: Service contracts generally escalate in price over time. As the machine gets older, the need for replacement parts increases. Service rates typically escalate yearly to cover those costs for the service provider. Escalation rates are typically in the 10-20% annual range. Review your contract for the limits on escalation. If you have a lease agreement that includes service, check the terms of the agreement to see if the provider can escalate the entire payment or only the service portion of the payment. This could mean a significant difference over the life of a lease.

For example, on a combined payment of $200 / month over 60 months, escalation of the entire payment or escalation of $50 for service and a set $150 for the lease, with a 10% annual escalation makes a difference of $1,989.18. Escalating at 20% would result in a $4,394.88 difference.

10% escalation of a combined service / lease agreement with entire payment escalating vs only the service portion escalating:

So, how much you should pay for your copier or printer depends on a number of factors, as we described above. Because you will be paying a service agreement and likely financing the purchase over 3-5 years, you want to choose the solution that will match your needs for that whole period.

Make sure you check all the terms so that you aren’t surprised when you get your bill or wondering why you are paying so much in year three compared to where you started. To learn more, schedule a Risk-Free Print Consultation today.