What is the Section 179 IRS Tax Code?

Let’s face it, taxes are complicated on a good day for the individual. When it comes to small business management and tax codes in Colorado you may be wondering how best to use Section 179 to reduce your operating costs.

While we always recommend that you have work directly on the details with your tax accountant or financial advisors, we thought we’d try to answer a few of your questions to help you with your conversation.

Every business owner would like to keep as much revenue as possible, taking advantage of tax opportunities to keep as much of your revenue in house as possible.

The Section 179 IRS tax code is defined as an immediate expense deduction that business owners can take for the depreciable business equipment instead of capitalizing and depreciating the asset over a period of time, typically 5 years.

In common language, the Section 179 code breaks down like this.

Typically, when you purchase a piece of capital equipment, like a copier or printer, the item (just like your car) starts to depreciate in value. That value is measured over the term of the lease/loan because in each year of the agreement the device is actually worth less on the open market. You are then able to write that portion of the depreciation off, offsetting any capital gains you may have made during the year with the deduction.

Makes sense so far…what’s the benefit?

With the Section 179 tax code, your business realizes the depreciation of the equipment immediately. This means that you can offset the entire value of the device against this year’s capital gains. (read: more cash flow for your business today). Obviously, most business owners would prefer to realize the deduction in this calendar year. Economies can be unpredictable and counting on unrealized money tomorrow isn’t the best way to manage your business.

You can use Section 179 to purchase equipment that can be written-off on your 2022 tax return (up to $1,080,000).

What are the small business Section 179 limits in 2022?

- The total cap to the amount that your write off is $1,080,000 (2022).

- The limit to the total amount of equipment purchased is $2,700,000 (2022).

- The deduction phases out, dollar-for-dollar after $2,700,00 in spending and is totaled once your business reaches $3,780,000 in purchases.

Can I use the Section 179 code to purchase or lease copiers and printers?

The short answer is yes, you can use the deduction to purchase any new or used business equipment. In the business solutions space this means that you can take the opportunity to purchase or lease, new or used.

- Copiers

- Printers

- Production Printing Devices

- Access Control | Equipment & Software

- Smart Board and Collaborative Devices

- Managed IT Services | Equipment

- Cloud Communications | Phone equipment & Software

When is the Section 179 deadline?

The equipment that you obtain must be used more than 50% of the time for business purposes in order to qualify. (Note: the equipment must be installed by December 31st, 2022. With the current supply chain issues surrounding the operating chips, toner, and devices you’ll want to place your orders as soon as possible.)

You’ll need to have your team multiply the cost of the equipment and/or the software by the percentage of business that you use to arrive at the monetary amount eligible for Section 179.

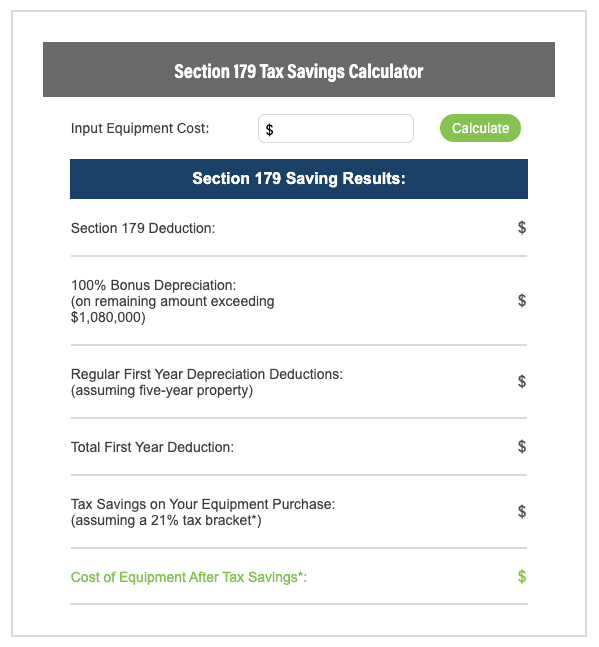

If you’re like me, you’d appreciate a Section 179 Tax Savings Calculator. Our friends at Leaf Financial have built you one.

What is Bonus Depreciation and how does it relate to Section 179?

According to the IRS, the 100% additional first year depreciation deduction that allows your business to write off the cost of most depreciable business assets in the year that you place them into service, in this case 2022.

You can use both Section 179 and bonus depreciation within the same year or you can choose to split the cost between years. In this case, you would use your Section 179 bonus (up to $1,080,000) and use bonus depreciation for any remainder, further offsetting your gains.

Again, with anything financial, we encourage you to speak with your tax advisor. Our goal here is to offer up a few thoughts to help you get the equipment you need now, with as much benefit to your organization as possible.

If you are planning to acquire capital investments like copiers and printer, or access control solutions, we recommend you reach out today to speak with a representative. Due to the current supply chain environment, you may need to act now in order to meet the delivery deadline of December 31st.