Section 179 Tax Benefits: Colorado Business

If you own a business in Colorado, or you’re looking to start one, you’ll want to pay close attention to a tax provision that could make a significant impact on your bottom line: Section 179. This tax benefit is designed to help businesses like yours invest in essential equipment and assets while enjoying substantial tax savings.

Understanding Section 179

Imagine you’re the owner of a growing small business. You’ve been that new production printer that could take your operations to the next level. Section 179 is here to help you achieve your goals. It allows you to deduct the cost of eligible assets as an expense, rather than spreading the deduction out over several years through depreciation.

The Benefits

One of the most attractive aspects of Section 179 is the upfront deduction. Instead of waiting for years to recoup your investment, you can enjoy immediate tax benefits. This means more money in your pocket (read: cash!) right now, which can be reinvested into your business, used to expand, or simply improve your financial stability.

Eligible Property

To make the most of Section 179, you need to invest in qualifying capital purchases. This typically includes tangible personal property like machinery, equipment, and vehicles, as long as they are used primarily for business purposes. The range of eligible assets is broad, allowing you to customize your deductions to fit your specific needs.

Limits and Thresholds

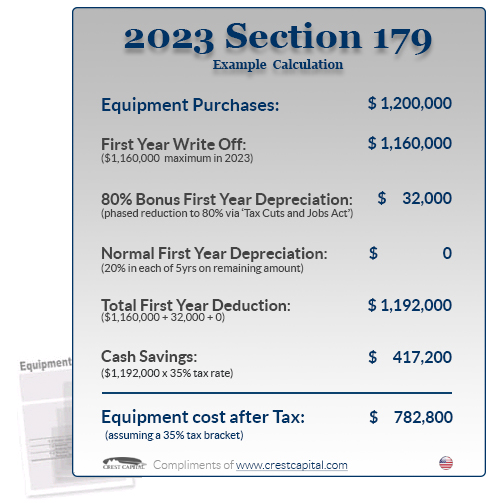

Remember that there are annual limits and thresholds associated with Section 179. The deduction limit can vary from year to year, but in recent times, it has been quite generous. This means you could potentially write off a significant portion of the cost of your assets, depending on your business’s circumstances.

However, be aware that there’s also a total investment limit. If your total asset purchases exceed this limit, the Section 179 deduction starts to phase out. So, it’s essential to plan your investments wisely to maximize your tax benefits.

Pass-Through Entities

If you are part of a business structured as an S corporation, partnership, or LLC? If so, the good news is that Section 179 isn’t limited to large corporations. These pass-through entities can also pass the deduction through to their owners, who can then benefit from it on their individual tax returns. It’s a way for small businesses and entrepreneurs to level the playing field when it comes to tax benefits.

Consult a Professional

Before you rush out and start buying equipment, it’s crucial to consult with a tax professional or CPA. They can help you navigate the specific rules and limits for the current tax year. They’ll ensure you’re taking full advantage of Section 179 without running afoul of the IRS.

In conclusion, Section 179 can be a game-changer for your business. It’s a powerful tool for driving growth, increasing your competitive advantage, and bolstering your financial health. By making smart investments in eligible property, you can enjoy immediate tax deductions and pave the way for a brighter financial future. So, don’t hesitate to explore the possibilities that Section 179 offers – your business success could depend on it.

What is the difference between Sect 179 and bonus depreciation?

Section 179 and bonus depreciation are both tax incentives that allow businesses to deduct the cost of certain assets, such as equipment and machinery, from their taxable income. However, they differ in terms of how they work and the types of assets they apply to:

Section 179:

- Deduction Timing: With Section 179, you can deduct the cost of eligible assets as an expense in the year the assets are placed in service. This means you can get an immediate tax benefit for the full cost of the asset in the current tax year.

- Eligible Property: Section 179 typically applies to tangible personal property used for business purposes. It includes assets like machinery, equipment, vehicles, and certain improvements to real property. There is a broad range of qualifying assets.

- Deduction Limits: The deduction limits under Section 179 vary from year to year, but they are typically quite substantial. For instance, in recent years, businesses have been able to deduct up to several million dollars in asset purchases.

- Phase-Out: If your total asset purchases exceed a certain threshold, the Section 179 deduction begins to phase out. Once you surpass the phase-out limit, the deduction is no longer available.

Bonus Depreciation:

- Deduction Timing: Bonus depreciation allows you to deduct a percentage of the cost of eligible assets in the first year they are placed in service. This percentage has been 100% in recent years, meaning you can deduct the full cost of qualified assets in the year they are acquired.

- Eligible Property: Bonus depreciation typically applies to new, tangible personal property with a recovery period of 20 years or less. This can include machinery, equipment, computers, and certain types of qualified improvements to real property.

- No Deduction Limits: There is no annual limit or phase-out for bonus depreciation, which can be especially beneficial for businesses that make large capital investments.

- Used Assets: Bonus depreciation can also apply to used assets, whereas Section 179 generally applies only to new assets.

To sum it up, the primary difference between Section 179 and bonus depreciation lies in the timing of the deductions and the types of assets that qualify. Section 179 allows for immediate expensing of the cost of eligible assets, often with limits and phase-outs, while bonus depreciation provides a first-year deduction of a percentage of the asset’s cost, typically with no limits and the possibility of applying to used assets.

Businesses often choose between these incentives based on their specific circumstances and asset purchase plans, and they may even use both in certain situations to maximize tax benefits. It’s essential to consult with a tax professional to determine the best approach for your business.

Is there a Section 179 calculator I can check to see how it will affect my business?

So glad you asked! Yes, our friends at Leaf Commercial Capital have taken the time to create a Section 179 calculator to help you understand what value you can find by using the deduction (this year up to $1,080,000, if all devices are installed prior to December 31st, 2023).

And of course, we’re always here to help you navigate the equipment and to understand what hardware is included, as well as what other capital expenses you may incur (think server upgrades, access control, smart boards, UCaaS devices, and video walls!). Feel free to reach out today for a risk-free environment assessment to see what opportunities your business has for upgrades today (with full use of the tax benefits).